Billion Dollars in Market Value

Apartment Units

Square Feet (M)

Equity Multiple

The Key to Our Success

A commitment to absolute integrity and making a difference while making a living drive what makes us different from any other company out there.

We’ve proven our competitive advantage lies within the relationships we’ve developed for over 5 Years. Our experienced professionals are able to leverage these relationships to consistently source exclusive and differentiated opportunities in these targeted markets for our clients.

Watch a Short Video of our work

We help clients in 73 cities multiply their fortunes. We are trusted and we do our best to earn and keep this trust.

Prices

Rise in real estate prices up to 28% per year.

GDP

Australia’s GDP growth 9.7% for 2022

Tax Rates

Europes lowest business tax rates

Value

Real Estate holdings have maintained their value over time.

What We Do

We prospect thematically in high-quality instruments, focusing where we see outsized growth potential driven by global economic and demographic trends.

Our vast portfolio provides us with proprietary information across every major real estate asset class in virtually every major market around the world, allowing us to identify themes and allocate capital with conviction.

The Best Prognosis

Connectivity and Scale

Client-Centric Considerations

Your Satisfaction is Our Priority

We are poised to deliver exceptional service, creating long-term client loyalty and retention.

Driven by our quest to provide the most accessible real estate solutions while ensuring the maximum safety of all our stakeholders, we utilize a holistic and simplified approach to delivering the best in housing solutions and creating thriving options in the African real estate landscape.

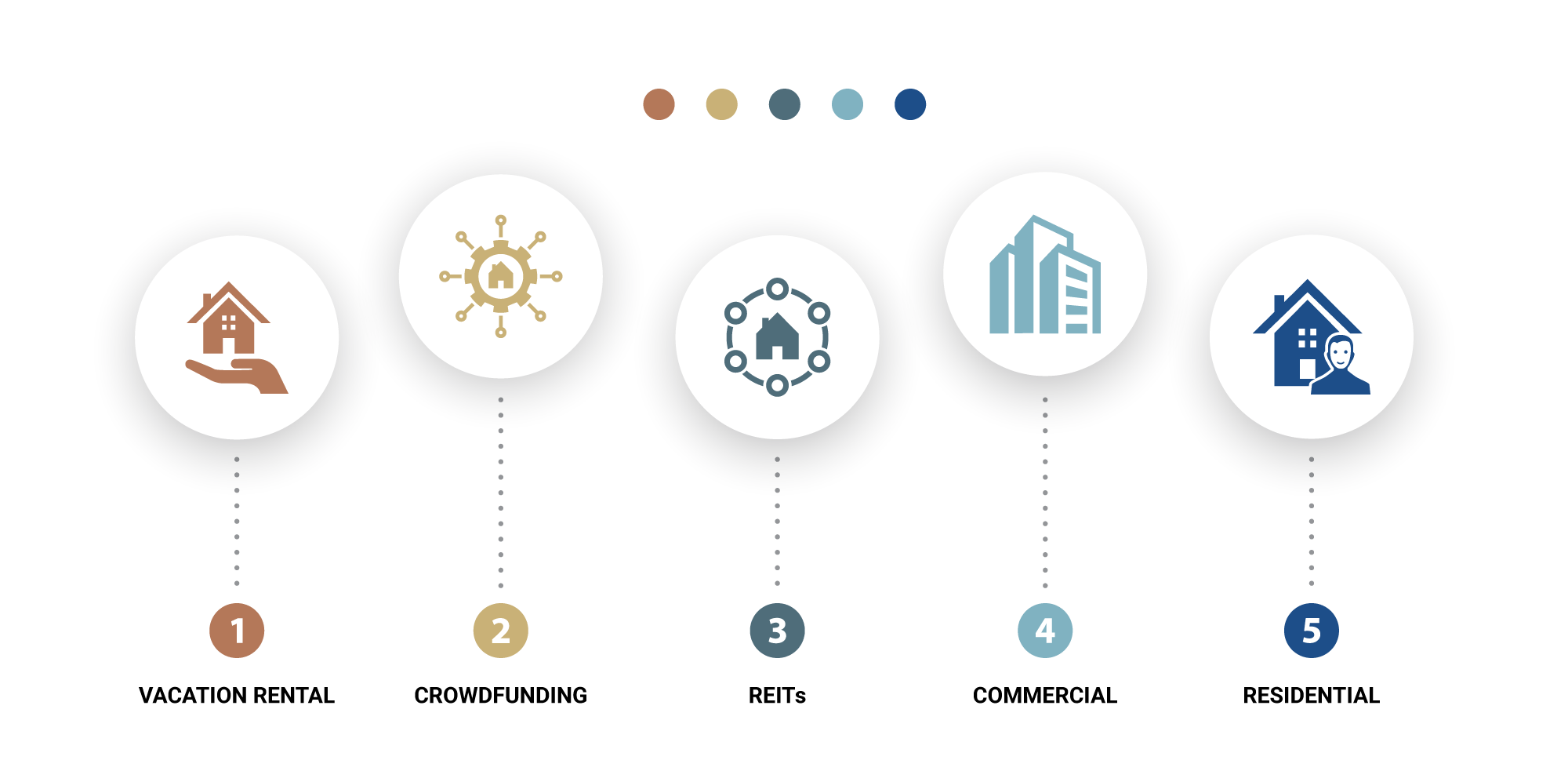

Our Kind of Real Estate

Real Estate Holdings

Real estate offer a diverse range of opportunities for clients seeking to build estates and achieve goals. From the stability of residential properties to the potential high returns of commercial ventures, the real estate market caters to various preferences and risk tolerances. Here are five types of real estate that you can explore:

What criteria do we use when selecting real estate for our portfolio?

We employ a meticulous selection process for real estate. We consider factors such as location, market trends, property conditions, and the potential for sustainable growth. Our focus is on properties that align with your objectives and offer long-term value appreciation.

How do we handle financing for Real Estate within our portfolio?

Principal for our real estate holdings involves a strategic approach. We assess various options, considering factors such as interest rates, loan terms, and potential returns. We ensure that the goal aligns with the overall strategy, optimizing returns while managing risk.

How crucial is effective property management in our Real Estate strategy?

Property management is integral to our real estate strategy. We emphasize meticulous oversight of day-to-day operations, tenant relations, and property maintenance. Effective property management ensures tenant satisfaction, stable rental income, and the long-term appreciation of our Real Estate portfolio, contributing to overall portfolio performance.

How do we approach risk mitigation in the realm of Real Estate?

Risk mitigation is a priority in our real estate strategy. We diversify our portfolio to spread risk across various property types and locations. Thorough due diligence, ongoing market analysis, and maintaining reserves for unforeseen circumstances are key components of our risk management approach. We also leverage the expertise of professionals to navigate potential challenges and optimize risk-adjusted returns for our clients.

Client-Centric Considerations

Our Prospecting Steps

Embarking on a real estate journey requires strategic planning and informed decision-making. Here are three essential steps to guide you through the process and position you for success in the dynamic world of real estate.

- Market Research – We research the local real estate market. Factors such as job growth, economic indicators, and development plans can impact property values.

- Goals and Strategy – We define together, your goals. Are you looking for long-term appreciation, rental income, or a combination of both? Understanding your objectives will guide your strategy.

- Plan Your Principal – We determine together, your budget and principal options. Include not just the purchase price but also closing costs, potential renovation expenses, and ongoing maintenance.