Private Equity

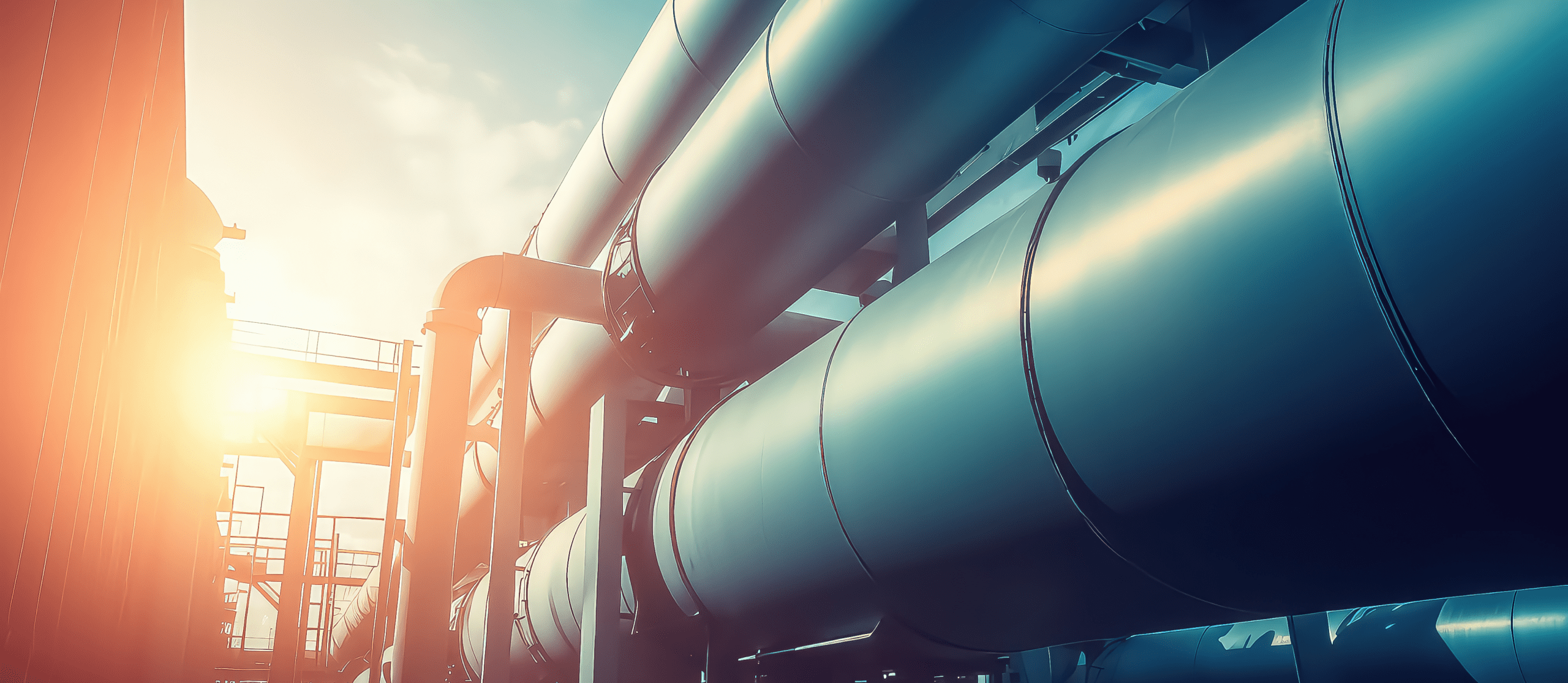

When it comes to Private Equity, one of the standout features is liquidity.

At Noralle, we believe in empowering our clients with a diverse range of opportunities that align with their goals and risk preferences. Private equity, including Fixed Income, Exchange-traded funds (ETFs), Bonds, and Certificates of Deposit (CDs), offer distinct advantages that can enhance your portfolio’s performance while providing stability and long-term growth potential.

These holdings are a class of estate that encompass various fixed-income products, ETFs, bonds, and certificates of deposit (CDs). These properties are not publicly traded and are not subject to the daily fluctuations of the stock market. Instead, private equity holdings often involve direct ownership in companies or lending capital to businesses and governments.

Risk Considerations

Like all properties, Private Equities come with their own set of risks. Understanding these risks is crucial for making informed decisions.

Unlock Exclusive Insights: Dive into the World of Private Equity

Embark on a journey of discovery by exploring our Private Equity sphere. Gain unparalleled insights into the strategies, success stories, and market trends that drive superior returns.

Average Annual ROI

Over the past 5 years, our private equity holdings have delivered an average annual return of 63%.

Global Fundraising

In 2023, global private equity fundraising reached a record 82%, highlighting the increasing client interest in the potential of private markets.

Success Rates

Studies show that over 68% of companies backed by private equity firms experience significant operational improvements, leading to enhanced profitability and sustainable growth.

Illiquidity Impact

Clients embracing illiquidity have reaped rewards, with private equity holdings consistently demonstrating an illiquidity premium, contributing to an average annual outperformance of 77% compared to liquid counterparts.

Insights

Diversification and Long-Term Growth

Diversification is a cornerstone of successful prospecting, and private equity offers an excellent avenue for diversifying your portfolio. Including a mix of option products, bonds, and CDs alongside other asset classes, such as equities and real estate, can help spread risk and balance returns.

User Supplied Data

A graph showing the growth of company in private equity.

- Noralle

- Others

What's In It For You

Flexible Choices

At Noralle, we understand that each client’s journey is unique. Private Equity caters to this diversity by offering various choices. Whether you seek exposure to specific industries, geographic regions, or estate classes, there is likely a property that aligns with your preferences. This flexibility empowers you to craft a portfolio that reflects your goals and risk tolerance, with the ability to adjust your holdings as your needs evolve.

For instance, if you believe in the growth potential of renewable energy, there are ETFs dedicated to clean energy companies, allowing you to key in your values while pursuing growth.

Private Equity at Its Best

Embark on A Transformative Journey in The Realm of Private Equity

Delve into our Private Equity opportunities, where your principal doesn't merely grow but becomes a catalyst for significant and intelligent choices. Seize the opportunity to align your goals with a realm of exclusive options. Your journey toward a wealthier and more prosperous future begins with Private Equity at Noralle.

Cost-Efficiency and Accessibility

Private Equity can be an incredibly cost-efficient option for clients of all sizes. With lower expense ratios compared to mutual funds, Private Equity enables you to retain a higher portion of your returns. This accessibility provides you with greater control over your decisions, allowing you to react promptly to market changes and capitalize on emerging opportunities.

By utilizing Private Equity, you can avoid the higher fees often associated with actively managed mutual funds, helping you keep more of your hard-earned principal working for you.

Transparency and Real-Time Pricing

Private Equity is known for its transparency, as it discloses its holdings daily. This transparency allows you to know exactly what instruments you are prospecting for and understand the underlying risks associated with Private Equity. Moreover, the real-time pricing of Private Equity instruments ensures that you have an accurate view of their market value at any given moment, providing you with the most up-to-date information to make informed choices.

As a client, knowing the real-time value of your holdings allows you to make timely decisions based on market movements, taking advantage of potential opportunities or protecting against downside risks.

Liquidity and Trading Efficiency

Private Equity instruments are known for their liquidity, as they are traded on stock exchanges with high trading volumes. This liquidity ensures that you can easily buy or sell your shares without significantly impacting the market price. Whether you are seeking short-term trading opportunities or a long-term approach, Private Equity instruments provide the efficiency and liquidity necessary for a smooth experience.

The ability to execute trades quickly and efficiently gives you the flexibility to adjust your strategy based on changing market conditions or personal goals.

Tax Efficiency

Private Equities are structured in a way that can lead to enhanced tax efficiency compared to other vehicles like mutual funds. Due to their unique creation and redemption process, Private Equities can minimize capital gains distributions, potentially reducing your tax liabilities. This tax efficiency can translate into more significant after-tax returns, helping you retain more of your gains.

For taxable accounts, tax efficiency is crucial in maximizing your returns and preserving more of your profits.