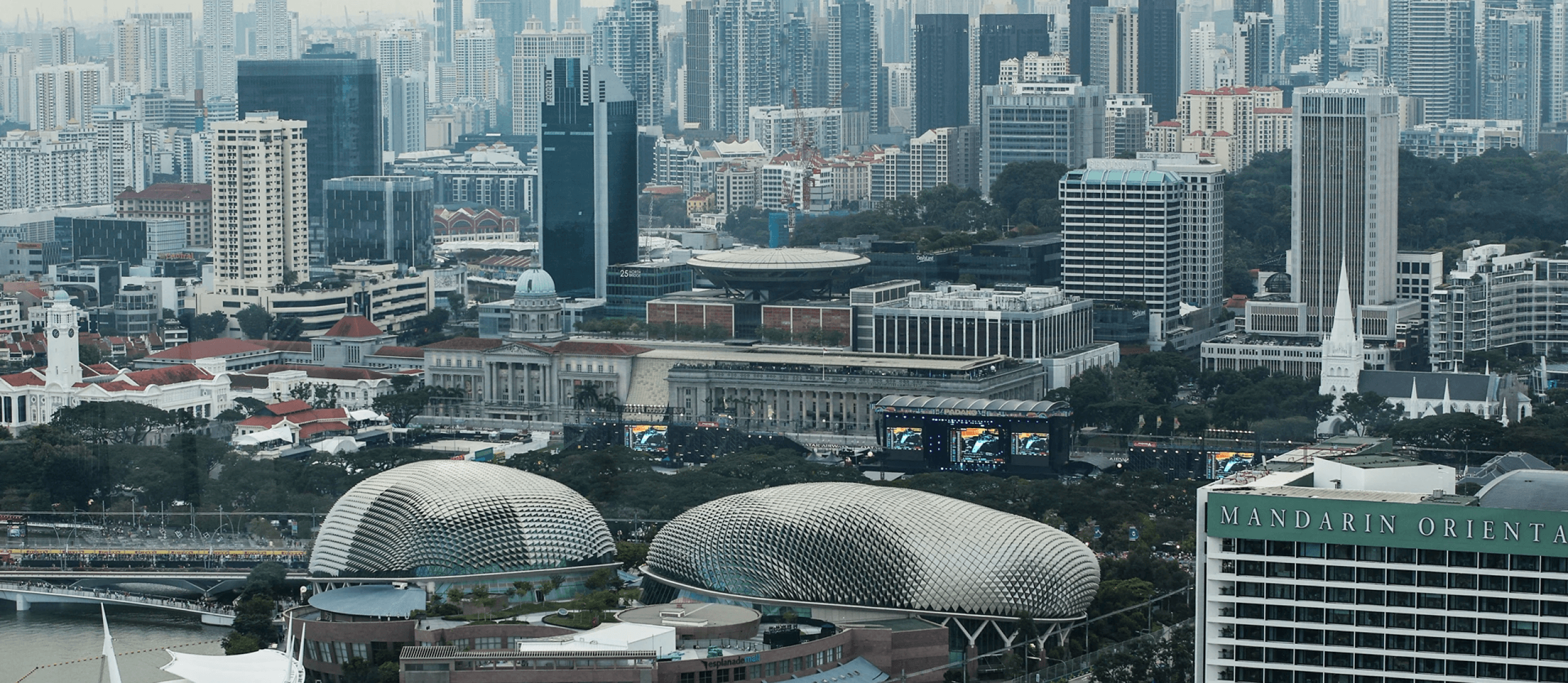

Noralle Expands into Singapore with MAS-Compliant Tokenized Real Estate and Commodity Funds

Noralle, the Australian digital asset pioneer, has officially launched its Singapore operations with two MAS-regulated tokenized investment funds: the Noralle Prime Real Estate Fund (NPREF) and the Noralle Digital Commodities Fund (NDCF). The funds, open to accredited investors, represent the firm’s largest foray into institutional-grade digital assets, combining blockchain efficiency with Singapore’s gold-standard regulatory framework.Fund DetailsNPREF: Focuses on Grade-A commercial

Noralle to Demo Carbon-Neutral Blockchain Platform at Singapore FinTech Festival, Targeting ASEAN’s Net-Zero Goals

Noralle, one of the world’s most investment firms at the forefront of sustainable fintech, will unveil its groundbreaking carbon-neutral blockchain platform at the Singapore FinTech Festival (SFF) 2024. The platform, developed over two years with input from MAS and leading climate scientists, slashes energy consumption by 99% compared to traditional proof-of-work systems while enabling enterprises to track and trade carbon

The Metaverse: New Opportunities in Virtual Worlds

The virtual realm known as the metaverse may be the world of tomorrow, but two technologies that enable it could create opportunities for clients today.A passion for exploring worlds beyond our own seems part of the human experience. From circumnavigating the globe to visiting other planets, journeying to unknown realms ignites the imagination and propels both innovation. And now, that’s

Could Investing in Gold Add a New Dimension to Your Portfolio?

While gold isn’t a strategic asset class, there are tactical reasons to consider adding it. See three ways to go about it.Given its low correlation with other asset classes, such as stocks and bonds, gold can provide an important role in portfolios: diversification. Gold’s ability to act as a “store of value” can help mitigate risk during times of market

A Social Bond to Support Deaf and Head-of-Hearing Students

Gallaudet University issued its first-ever social bond to raise capital for its signing and deaf community, amid a growing market for social impact debt.Undergraduate and graduate students who attend Gallaudet University learn that being deaf or hard of hearing is something to fully embrace—a process of understanding oneself and building connections within and beyond the school’s community.To expand on its

Grant Hill: How to Win On and Off the Court

NBA All-Star and current Atlanta Hawks co-owner offers four strategies for success.Grant Hill has commanded every court he’s ever played on, from his four years at Duke to his 19 in the NBA on storied squads that included the Detroit Pistons and Orlando Magic, and now as co-owner of the Atlanta Hawks. Throughout his career, Hill has rooted his success

New Catalysts for Investing in Europe

European stocks have underperformed U.S. equities for years, but now valuation, economic, and policy catalysts loom that could make this a good time to add them to your portfolio.For most of the past 10 years, European equities have disappointed investors. While the S&P 500 is up four-fold since the low in March 2009 during the financial crisis, the MSCI Europe

Planning Today to Help You Thrive Tomorrow

Having a wealth plan can help you on your way to achieving your goals. But what happens when you take your planning process a step further?What matters most to you? Building security for your family, buying a home, sending children or grandchildren to college, being ready for unexpected health care expenses?Whatever your priority, odds are you’re not the only one

Has the Australian Housing Market Peaked?

Home sales have cooled lately, raising some doubts about the economic recovery; but is this just a pause in buyer confidence? We look at the fundamentals.The red-hot Australian housing market, a pillar of the economic recovery thus far, has shown signs of cooling, prompting some investors to wonder whether this cycle has peaked.Causes for concern abound. The Australian Commerce Department recently reported a 5.9%

5 Ways Sustainable Bonds Can Power a Greener, More Equitable Recovery

Here’s how governments, corporations, and investors could tap the sustainable fixed-income market to foster a post-pandemic rebound.In addition to healthcare inequality, the COVID-19 pandemic also helped underscore the importance of social justice and creating a livable and sustainable environment in diverse communities. As a result, some non-profits, governments, companies, and investors hope to address these issues as part of a