Noralle Expands into Singapore with MAS-Compliant Tokenized Real Estate and Commodity Funds

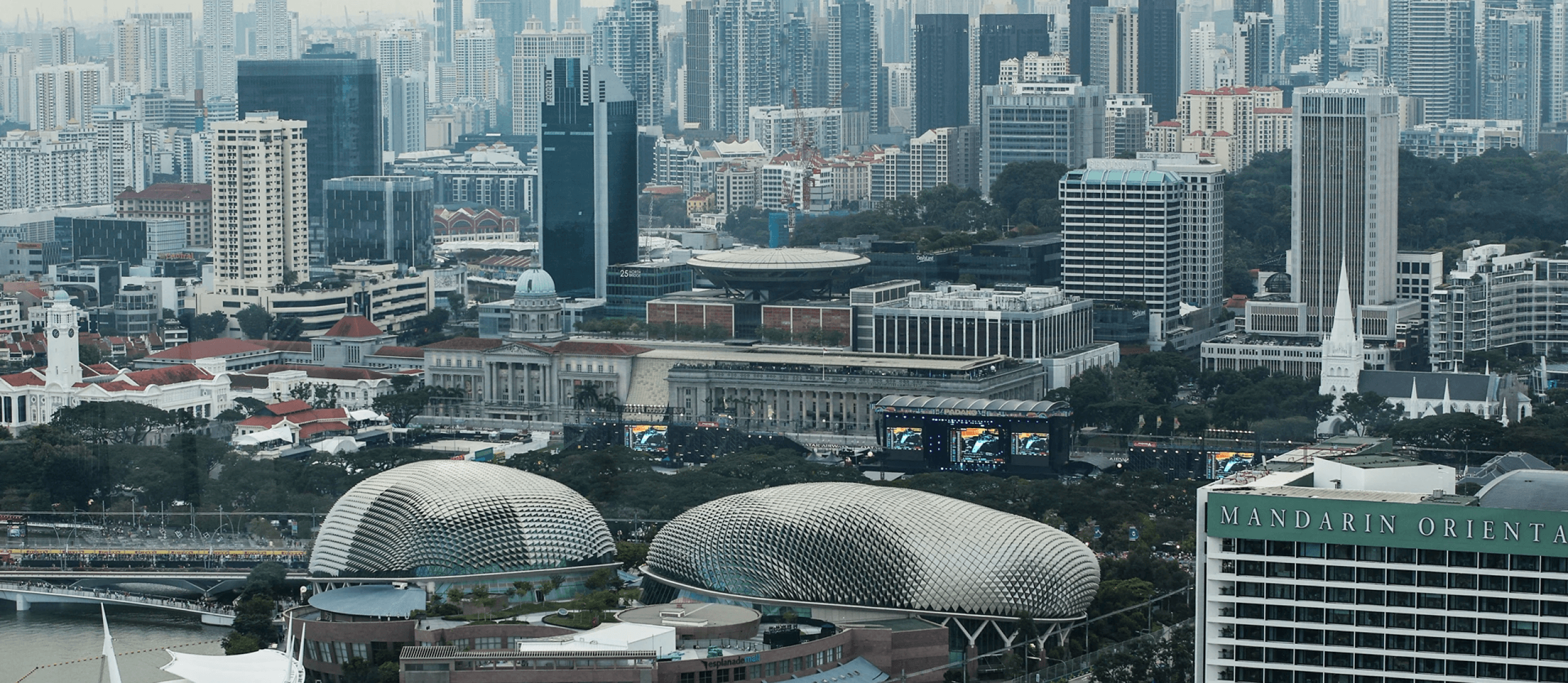

Noralle, the Australian digital asset pioneer, has officially launched its Singapore operations with two MAS-regulated tokenized investment funds: the Noralle Prime Real Estate Fund (NPREF) and the Noralle Digital Commodities Fund (NDCF). The funds, open to accredited investors, represent the firm’s largest foray into institutional-grade digital assets, combining blockchain efficiency with Singapore’s gold-standard regulatory framework.

Fund Details

- NPREF: Focuses on Grade-A commercial properties in Singapore’s Marina Bay and Sydney’s Barangaroo districts. Investors earn quarterly rents distributed via smart contracts.

- NDCF: Tracks physical gold and lithium reserves in Australia, with prices pegged to real-time commodity exchanges.

Why Tokenization?

- 24/7 Trading: Assets can be bought/sold globally without traditional market hours.

- Fractional Ownership: Minimum investment lowered to $1,000, expanding access beyond ultra-high-net-worth individuals.

- Instant Settlement: T+0 transactions via Noralle’s proprietary blockchain.

The funds have already attracted $150 million in commitments from Asian family offices, European pension funds, and Middle Eastern sovereign wealth entities.

Both funds comply with MAS’s Digital Payment Token (DPT) Guidelines and Anti-Money Laundering (AML) standards. Noralle’s Singapore team includes ex-regulators and compliance veterans.

“Tokenization is the future of finance, and Singapore’s clear regulations and investor appetite make it the perfect hub to scale this revolution.” said Emily Zhao, Noralle’s Chief Investment Officer

The global tokenized asset market is projected to reach $10 trillion by 2030, with real estate and commodities leading adoption. Noralle plans to add private equity and carbon credit funds to its Singapore portfolio in 2025.

About NoralleNoralle is an Australian investment firm headquartered in Queensland, specializing in technology-driven opportunities across the Asia-Pacific region and ESG-aligned strategies.

The firm empowers individuals and businesses through diversified portfolios spanning smart cities, renewable energy, blockchain infrastructure, real estate, and digital assets. Known for its transparency and client-centric approach, Noralle leverages cutting-edge fintech tools to democratize access to high-growth markets while prioritizing climate-conscious investments.

With a seasoned team of advisors and a track record of balancing financial resilience with societal impact, Noralle has become a trusted partner for tailored solutions in Southeast Asia’s evolving tech and sustainability landscapes.

Media Contact:Sophia Tan,

Head of Communications