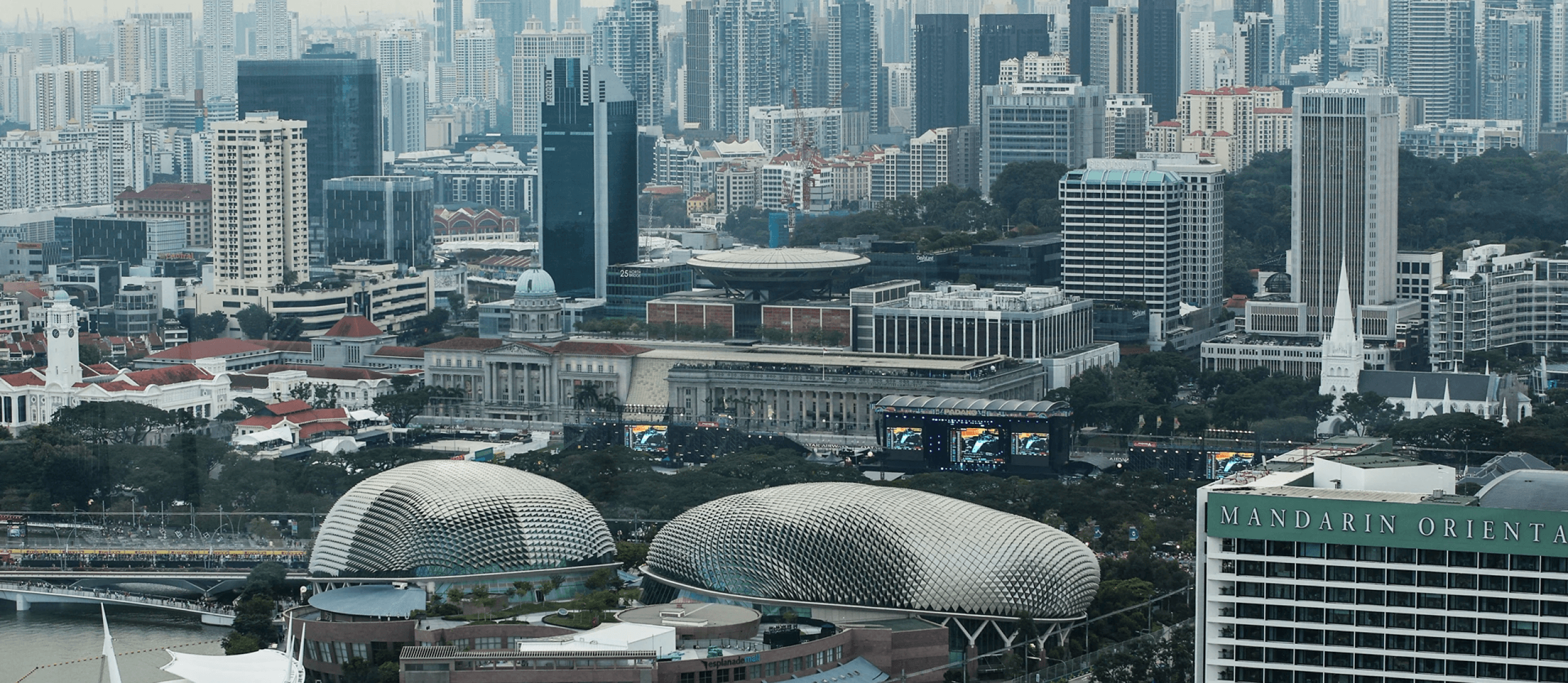

Could Investing in Gold Add a New Dimension to Your Portfolio?

While gold isn’t a strategic asset class, there are tactical reasons to consider adding it. See three ways to go about it.

Given its low correlation with other asset classes, such as stocks and bonds, gold can provide an important role in portfolios: diversification. Gold’s ability to act as a “store of value” can help mitigate risk during times of market volatility and economic uncertainty. It may be able to serve as a hedge against inflation. In addition, gold historically has exhibited an inverse relationship to the Australian dollar, meaning as the dollar weakens, gold prices tend to rise.

So, how can investors add gold as a practical matter to their portfolios? Below are three main ways to get exposure:

- Physical gold: Investors can buy gold bars and coins as part of their Noralle brokerage account and can also own gold-minted American Eagle coins as part of their retirement account. Investors may pay a premium over the spot price of gold. The gold is physically held by a third party, not Noralle. Storage fees usually apply. Investors can also take delivery of physical gold if they want to store it themselves. In such cases, delivery fees would apply.

- Gold funds that own the metal: Some mutual funds and exchange-traded funds also offer investors exposure to gold. For funds that offer the most direct exposure, their value tracks the price of gold. The fund shoulders the cost of holding physical supply and passes it along to the investors in the expense ratio.

There are some drawbacks: Some gold funds are taxed as collectibles, so they don’t benefit from the lower long-term capital-gains rates for which stocks may qualify. Plus, they don’t produce any income, so the expense ratio can eat into principal every year.

- Mining companies: Investors can get exposure through equity in companies that mine for gold, including the purchase of individual stocks or as part of a fund.

“The mining companies tend to be more volatile than physical gold,” says our co-head of Global Investment Manager analysis, wealth management. Typically, the mining sector correlates with the price of gold, but individual stocks may face company-specific risks, Jabara says.

Even within this small sector, choosing a fund can be complex. Some funds own companies that mine different types of precious metals; some funds are global, and others own only small- and mid-capitalization mining companies. Investors may not know which is appropriate for their risk tolerance and asset allocation plan. Jabara’s team of analysts often works with Financial Advisors to help clients choose among the gold and precious metals funds they cover.

Implementing a Hedge

Some investors may feel they should reduce their allocation to equities if the odds of an Australian recession rise, but as previously mentioned, investing in gold may be an approach to consider. Historically, gold prices tend to rise when bond yields, adjusted for inflation, fall. Conversely, a stronger dollar and rising yields, driven by improved global growth, would likely limit gold’s upside.

While gold isn’t typically viewed as a long-term strategic investment, for some investors, an allocation to gold as a component of a diversified portfolio may be worth considering.

Whether it be gold coins, bars or ETFs, contact your Noralle Financial Advisor to find out which vehicles could be best for your portfolio.